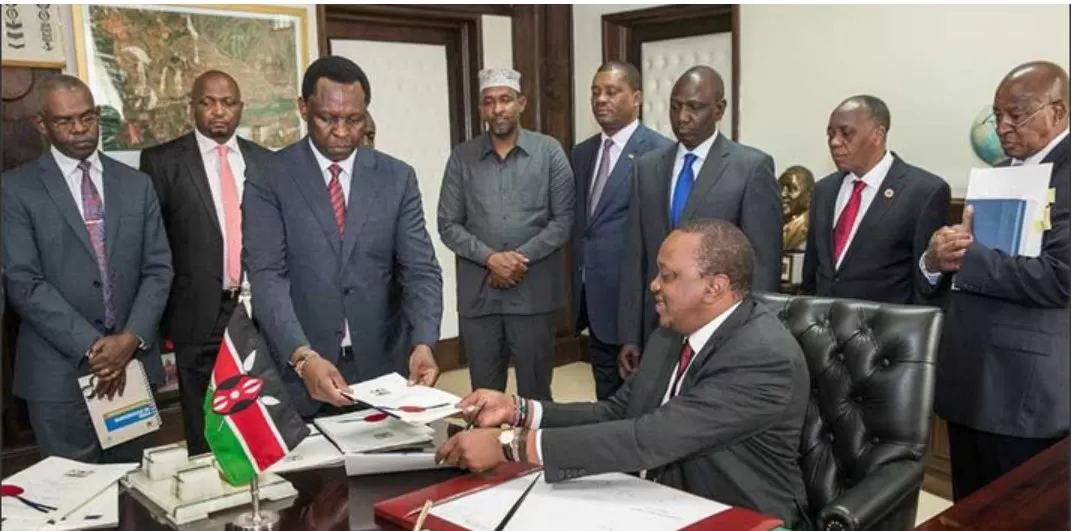

Al-Shabaab’s latest terrorist attack at the DusitD2 hotel and business complex on Tuesday 15 January 2018, provides an opportunity to strengthen Kenya’s Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) frameworks. This is because an existing amendment to the Tax Procedures Act 2015, introduced by the Finance Act 2018, weakens current financial reporting, investigations and surveillance mechanisms carried out by the Financial Reporting Centre (FRC), and other various financial institutions such as the Central Bank of Kenya (CBK) plus other financial sector regulators as mandated by law. At least 21 people died, while 28 people were reported as injured when armed militants stormed the luxury hotel compound in Nairobi. In his address to the nation, concerning the attack President Uhuru Kenyatta promised fellow citizens that Kenya’s security agencies “…will seek out every person that was involved in the funding, planning and execution of this heinous act.”

This statement reinforced his 2018 Jamuhuri Day speech in which he indicated that the government is keen to prevent illicit financial flows that jeopardizes both national and human security through corruption, drug smuggling, child or human trafficking and jeopardizing delivery of public services. Money laundering and terrorism financing are major elements in the execution of terrorist plots. This is because operatives need finances to sustain themselves during target selection, surveillance, preparation and implementation of their evil schemes to harm innocent civilians. Recent reports have pointed to how one of the attackers camouflaged himself by living an ordinary but somewhat affluent lifestyle that afforded: food; proper grooming; residence in a middle-income estate; and the luxury of an accessorized a vehicle which sustained both him and his wife. This points to undetected access to resources but also reminds Kenyans of the history pointing to when Osama Bin Laden once owned an Ostrich farm in Kenya whose funds are believed to have been used in the Nairobi 7 August 1998 Bomb blast attacks and the American September 11 attacks.

Currently, Kenya’s AML/CFT regulatory frameworks are governed by the Proceeds of Crime and Anti-Money Laundering Act, 2009 (POCAMLA) and the Prevention of Terrorism Act, 2012 (POTA). POCAMLA particularly seeks to: criminalize money laundering plus provide measures for combating it; provide for the identification, tracing, freezing, seizure or confiscation of proceeds of crime; and provide for international cooperation or assistance in money laundering investigations plus proceedings. Other than formalizing the establishment of the Assets Recovery Agency (ARA), POCAMLA also aims to target incidences of economic crimes. Following an amendment in 2017 to POCAMLA the law now imposes penalties to those found culpable of crimes as a means of tackling corruption, curbing the financing of terrorism, and preventing drug trafficking.

Beyond the political will, this amendment has legislatively emboldened the multi-agency coordination between the members of the National Taskforce on Anti-Money Laundering and Combating the Financing of Terrorism (NTF) such as: The Directorate of Criminal Investigations (DCI); The Director of Public Prosecutions (DPP); Kenya Revenue Authority (KRA); The FRC; The Ethics and Anti-Corruption Commission (EACC) among others.

However, last year, the Finance Act 2018 Clause 38 introduced an amendment to Section 37B (4) to the Tax Procedures Act 2015 exempting money remitted from a foreign country under amnesty as provided for under the section from the provisions of POCAMLA.

The section extends a pre-existing tax amnesty for money transfers repatriated from incomes or investments held in foreign countries by one year with the intention of encouraging the remittances of funds held outside Kenya into the country to boost the economy considering current domestic revenue mobilization efforts. Unfortunately, this exemption opens a loophole in the financial system that could be exploited to repatriate proceeds of terrorism and crime. It also opens the country to security threats because such a blanket exemption weakens current know-your-customer rules and disclosure procedures under the POCAMLA and the CBK Prudential Guidelines. This in turn opens varied ways for the entry of suspicious funds that could fund terrorism and other similar organized crimes.

In as much as the amendment excludes funds derived from proceeds of terrorism, poaching and drug-trafficking, it remains unhelpful because money does not come labeled. First, illicit money is always disguised as legitimate, and it is only upon inquiry that their legality or otherwise can be ascertained. Secondly, there are many other sources of illegitimate funds that would be a subject to scrutiny in relation to money laundering, and terrorism financing. Therefore, it is only upon inquiry as provided for by POCAMLA and CBK Prudential Guidelines that the suspect origin of funds of whatever kind can be detected. Consequently, in a forthcoming tax justice study on An Assessment of the Finance Act 2018 against the Background of Kenya’s Anti-Money Laundering and Counter-Terrorism Financing Obligations, by legal expert Dr. Eric Kibet recommends that the Government, both the National Assembly and the Executive should take steps to repeal Section 37B (4) to the Tax Procedures Act 2015.

The Executive should therefore specifically initiate this process because it is the arm of government charged with effective enforcement of AML/CTF frameworks in the country. On its part, the National Assembly should legislate to drop this section because the power to make and unmake laws of this nature rests primarily within its mandate.

The author is Coordinator of the East Africa Tax and Governance Network (EATGN). Email: lwanyama@taxjusticeafrica.net , Twitter: @lennwanyama