Africa loses US$88.6 billion or 3.7 per cent of its gross domestic product (GDP) annually, to Illicit financial flows (IFFs), according to UNCTAD (2020). These flows originate from sources such as revenues from illegal activities, tax avoidance and evasion, transfer pricing, trade mis-invoicing, and corruption.

IFFs divert resources from social development and hinder financing development in Africa by undermining domestic resource mobilisation efforts. As a result, governments are unable to provide the necessities required for citizens to develop and contribute effectively to economic growth.

This has led to a systematic revocation of human and economic rights even though most African constitutions guarantee the preservation of human rights and in many instances economic rights are justiciable. Making governments account for their inability or unwillingness to provide basic services is always a difficult task and, in some instances, risky depending on the protection of civil liberties and resources available to public interest groups.

The use of court action to pursue the goals of social justice has increasingly become a mechanism for pursuing the goals of social justice and enhanced democratic constitutionalism. There have been an increasing number of public interest litigation (PIL) cases in Africa in the context of socio-economic justice and human rights. PIL is an important tool for the advocacy of socio-economic justice and the development of policies that adequately address the factors that underpin tax injustice and IFFs.

In June 2022, TJNA held its first public litigation retreat under the theme "Using Public Interest Litigation to Curb Illicit Financial Flows and Tax Injustice" in Nairobi, Kenya.

Some of the outcomes of this meeting included the following:

-

The need to develop a strategy to document, support and harmonize efforts among the various petitioners across the continent and to develop a “best approach” that can serve as a blueprint for new and ongoing cases. In other words, developing a Public Interest Litigation toolkit.

-

The need to build a compendium of cases on public interest litigation promoting tax justice and addressing Illicit Financial Flows (IFFs).

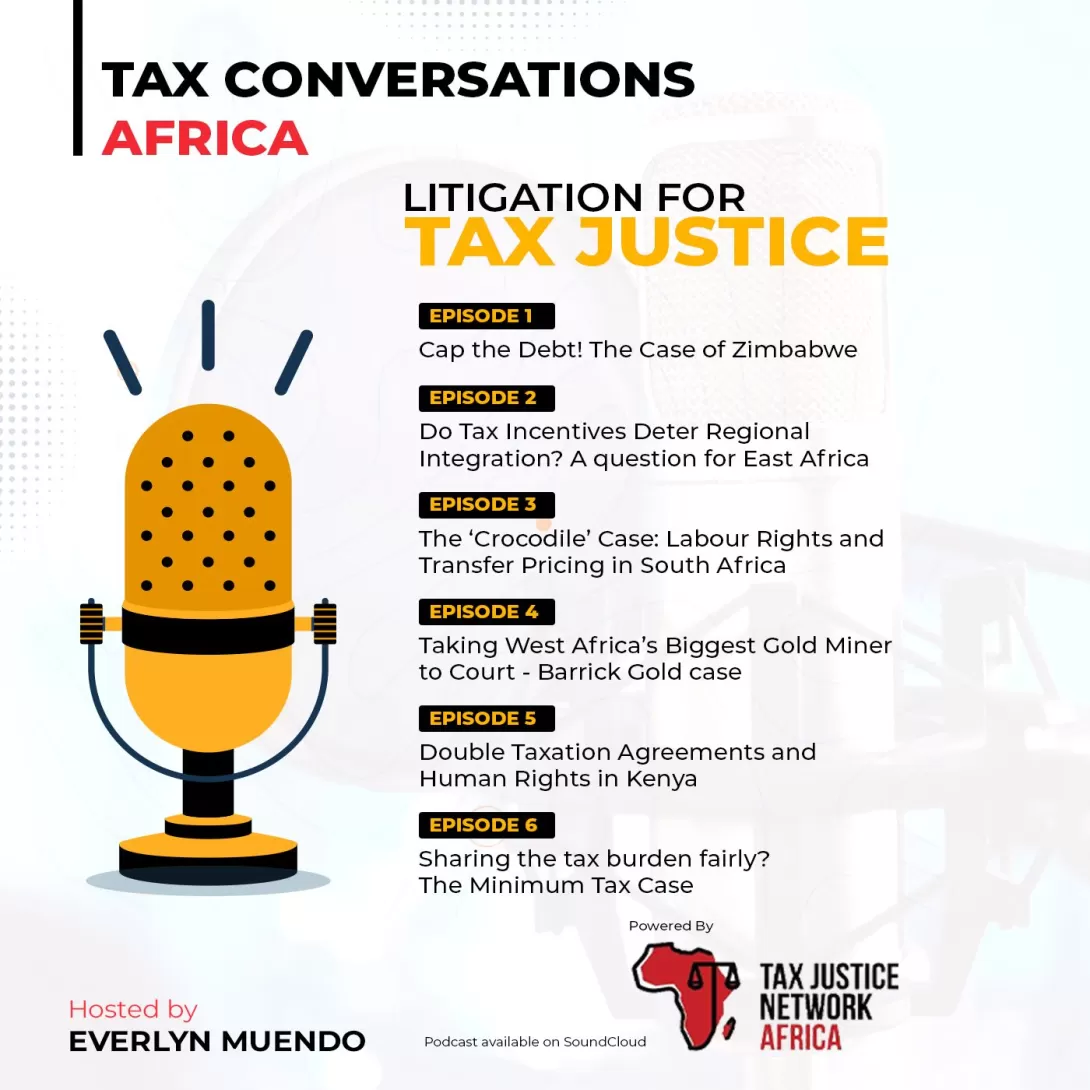

To boost advocacy efforts, TJNA hosted a 6-part podcast series on PIL. The podcast series raises awareness on public interest litigation to address economic/tax injustices and illicit financial flows.

The featured topics are:

-

Cap the Debt! The Case of Zimbabwe by Janet Zhou- Executive Director of Zimbabwe Coalition on Debt and Development (ZIMCODD).

-

Do Tax Incentives Deter Regional Integration? A question for East Africa -The TJNA East African Court of Justice case by Everlyn Muendo, Policy Associate Tax Justice Network Africa.

-

The ‘Crocodile’ Case: Labour Rights and Transfer Pricing in South Africa by Jaco Oelofsen- Tax Justice Programme Officer, Alternative Information & Development Centre (AIDC).

-

Taking West Africa’s Biggest Gold Miner to Court- Barrick Gold case- Senegal by Birahime Seck- Coordonnateur général du Forum Civil, section sénégalaise de Transparency International.

-

Double Taxation Agreements and Human Rights in Kenya by Sumayyah Mokku- Associate, Bashir, and Noor Advocates.

-

Sharing the Tax Burden Fairly: The Minimum Tax Case by Baston Woodland- Corporate Commercial lawyer, and tax law practitioner at Baston Woodland & Company Advocates.

Listen to the podcast preview: https://tjna.me/3Sy9XWQ

For more information, please contact emuendo(at)taxjusticeafrica.net