Date

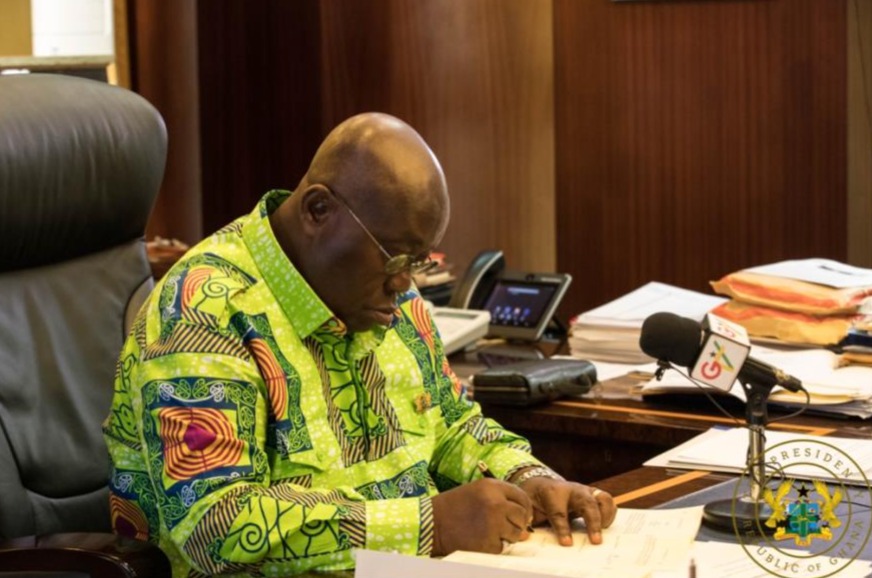

When President Nana Akufo-Addo signed Ghana’s Excise Duty (Amendment Bill), 2022, the arduous petition by TJNA and civil society organizations had come to a rewarding end. Months of evidence-informed advocacy resulted in legislation that will significantly bolster the objectives of Ghana’s Public Health Act 2012 and its obligations under the WHO Framework Convention on Tobacco Control (WHO FCTC).

The new bill, which was signed into law in April 2023, outlines a tax increment on health-harming commodities. It shifts Ghana’s tax regime on tobacco products from ad valorem excise to specific excise on cigarettes, cigars, negroheads, electronic cigarettes, and smoking devices.

According to figures presented by Ghana’s Minister of Finance Hon. Ken Ofori-Atta, in a memorandum, the bill will bolster the government's overall revenue derived from tobacco-related taxes. Forecasts indicate that revenue will surge from an estimated GHS 235 million (USD 23 million) in 2023 to approximately GHS 450 million (USD 40 million) in 2024. Besides the revenue boost, Ghana Non-Communicable Diseases (NCD) Alliance noted that the bill is also projected to address a major public health concern.

To start the process, a national stakeholders’ meeting set the pace for the need to change the tobacco tax regime in Ghana. The meeting brought together key stakeholders including the Ministry of Finance, Ministry of Health, Ghana Revenue Authority, Food and Drugs Authority, CSOs, Academia, media, youth, and women groups.

With TJNA’s support, a study titled ‘The Economics of Tobacco in Ghana’ was launched in January 2022 to provide evidence on the need for a change in the tobacco tax regime. The study highlighted the tobacco burden on Ghana’s economy and public health, noting 3.95% and 1.23%of male and female deaths respectively attributed to tobacco use. The study called for the design and implementation of appropriate policies to curb these adverse effects to public health while boosting domestic revenue.

The study recommended the following;

- Collaboration between government agencies and CSOs to strengthen sensitization on the deleterious effects of tobacco use,

- Ghana government should set up a tobacco control surveillance system to enforce and ensure compliance with tobacco control policies.

- As a matter of priority, the Ministry of Finance and the Ghana Revenue Authority should ensure that the share of tobacco tax in the retail price meets the WHO recommended 70-75% level.

The study was followed by a series of engagements where stakeholders presented to government and legislature the proposals to change tobacco taxation from ad valorem to either hybrid excise or specific excise. VALD-Ghana further commissioned an opinion poll to ascertain public support for tax measures on tobacco products. 72% of respondents indicated their support for a tax increase on tobacco products and 82% affirmed that taxes on tobacco will increase government revenue.

When the Minister of Finance finally presented the 2023 budget statement to parliament in November 2022, it included the shift from the current ad valorem to a hybrid system as recommended by the report. The proposals in the budget statement were opposed by the industry and minority in parliament. Under the Ghana Federation of Labour and the American Chamber of Commerce-Ghana, the industry argued against the proposed bill saying that it would impact government revenue, jobs and economic growth.

Despite the stiff opposition, the bill was passed by parliament in March 2023 and sent to the President for his assent. In the face of further opposition by the tobacco industry, the CSOs led by VALD-Ghana appealed to the President to assent the bill for health and revenue benefits.

When President Akufo-Addo finally assented to the bill, CSOs only prayer was that tax revenue from the bill should be geared towards health-promoting initiatives to maximize the envisioned public health benefits. In a statement issued by the CSOs, Mr. Labram Musah, the Executive Director of Programs at VALD-Ghana, explained that countries with earmarked health tax revenues had reported a sustainable funding source for health interventions and projects.

"We applaud the government for heeding our advocacy calls and taxing health-harming commodities to protect public health, but we want to emphasize that maximum public health and economic gains can only be achieved if the health tax revenue is earmarked.” Mr. Musah added.

For more information on our tobacco taxation work, please contact Rodgers Kidiya at rkidiya[@]taxjusticeafrica.net.

Photo courtesy